In the realm of public policy, taxation has long been a tool for raising revenue, redistributing wealth, and influencing economic behavior. However, in recent years, the concept of behavioral taxation has gained significant traction. This approach to taxation doesn't merely focus on revenue generation but also aims to modify individual and corporate behaviors to achieve specific social and environmental objectives. Behavioral taxation is particularly relevant in contexts like sugar consumption, where the stakes involve public health, environmental sustainability, and long-term economic stability.

This article delves into the importance of behavioral taxation, using sugar taxes as a primary example to illustrate how this approach can lead to positive societal outcomes.

What is Behavioral Taxation?

Behavioral taxation is based on the principles of behavioral economics, which studies how psychological, social, and emotional factors influence economic decisions. Traditional economic theory assumes that individuals act rationally to maximize their utility. However, behavioral economics recognizes that humans often make irrational decisions due to biases, heuristics, and limited self-control.

Behavioral taxation leverages this understanding to design tax policies that nudge individuals and businesses toward more desirable behaviors. Rather than simply penalizing undesirable actions, behavioral taxes are structured to make certain choices more or less attractive, thereby guiding behavior in a way that aligns with broader societal goals.

The Case for Behavioral Taxation

The primary argument for behavioral taxation is that it can address market failures and externalities more effectively than traditional regulatory approaches. Market failures occur when the free market fails to allocate resources efficiently, often due to externalities—costs or benefits that affect third parties who are not involved in the economic transaction. For example, the excessive consumption of sugary drinks creates negative externalities, such as increased public health costs due to obesity and related diseases.

Behavioral taxes can help internalize these externalities by aligning private incentives with social costs and benefits. In other words, they make it more expensive to engage in harmful activities (such as consuming sugary drinks) and cheaper to engage in beneficial ones (like consuming healthier foods).

Behavioral Taxation and Sugar Consumption

Sugar consumption is closely linked to public health concerns such as obesity, diabetes, and heart disease. Traditional public health campaigns have often focused on education and awareness, urging people to make healthier choices. However, these approaches have had limited success, as they rely on individuals to change their behavior voluntarily.

Behavioral taxation, in contrast, uses financial incentives to make healthier choices more appealing. The most common example is the sugar tax—a levy on sugary drinks and snacks designed to reduce consumption by making these products more expensive. Countries like the United Kingdom, Mexico, and France have implemented sugar taxes with varying degrees of success.

Evidence of Success: The Impact of Sugar Taxes

The evidence suggests that sugar taxes can be effective in changing consumer behavior. For example, after Mexico introduced a sugar tax in 2014, the consumption of sugary drinks dropped by about 7.6% over two years, with the reduction being more pronounced among low-income households, who are more sensitive to price changes.

Figure 1 from a study conducted by Colchero and colleagues, published in Health Affairs in 2017, shows the adjusted estimated and counterfactual volumes of taxed beverages purchased in Mexico during 2014-2015. There was an average decline of 5.5% in 2014 and an average decline of 9.7% in 2015, resulting in an overall decline of 7.6% for the entire study period. This suggests that behavioral taxation can effectively reduce the consumption of unhealthy products, especially in populations with higher price sensitivity.

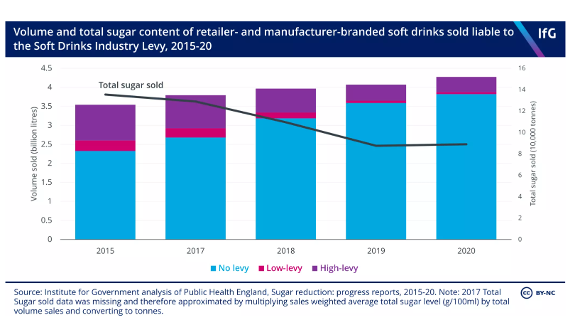

Similarly, the introduction of a sugar tax in the United Kingdom in 2018 led many beverage manufacturers to reformulate their products to reduce sugar content, in order to avoid the tax. This not only led to lower sugar consumption but also demonstrated how behavioral taxation can drive industry-wide changes that benefit public health.

Figure 2 from the Institute for Government highlights the impact of the UK's Soft Drinks Industry Levy (SDIL). Between 2015 and 2019, the total sugar sold in soft drinks by retailers and manufacturers decreased by 35.4%, from 135,500 tonnes to 87,600 tonnes. Over the same period, the sales-weighted average sugar content of soft drinks declined by 43.7%, from 5.7g/100ml to 2.2g/100ml. The primary mechanism driving these reductions has been recipe reformulation, representing 83% of SDIL-associated reductions in weekly calorie intake from soft drinks. This indicates that well-designed behavioral taxes can lead to substantial reductions in harmful consumption without a corresponding increase in the consumption of other sugary products, thereby contributing to a healthier population.

In 2017, the Portuguese government introduced a special consumption tax on sweetened beverages, designed to reduce sugar intake through economic incentives. The tax was divided into two tiers, depending on sugar content: drinks with less than 80g of sugar per liter were taxed at a lower rate, while those with more than 80g per liter faced a higher tax. A study conducted by Goiana da Silva and colleagues, published in The Lancet Public Health in 2018, examined the impact of this tax. The results showed a 7% reduction in sales of sweetened beverages due to price elasticity and reputational effects. Furthermore, the reformulation of products led to an 11% reduction in total energy intake from sweetened beverages among the Portuguese population. This reduction is projected to prevent or delay at least 27 deaths annually related to excessive sugar consumption.

Figure 3 illustrates the substantial reduction in the sugar content of beverages, which emerged as the most critical public health effect of Portugal's sugar tax. This outcome underscores the importance of such taxes in encouraging industry reformulation and improving public health.

The Broader Implications of Behavioral Taxation

Behavioral taxation has broader implications for how governments approach public policy. By focusing on influencing behavior rather than merely raising revenue, policymakers can design tax systems that are more responsive to social and environmental challenges. This approach can also enhance the legitimacy of tax policies, as they are perceived as being more aligned with public welfare rather than simply a means of filling government coffers.

Moreover, behavioral taxes can be more politically feasible than traditional taxes. By gradually nudging behavior rather than imposing sudden, significant costs, these taxes can reduce public resistance and make it easier to implement necessary but potentially unpopular policies.

Challenges and Considerations

Despite its potential, behavioral taxation is not without challenges. One concern is the risk of regressive impacts, where taxes disproportionately affect low-income households. This is particularly relevant in the case of sugar taxes, as these expenditures make up a larger share of the budget for poorer families.

To address this issue, policymakers can design behavioral taxes with accompanying measures to protect vulnerable groups. For example, revenue from sugar taxes could be used to subsidize healthier food options or fund public health initiatives that directly benefit low-income communities.

Another challenge is ensuring that behavioral taxes are set at the right level to achieve the desired behavioral change without causing unintended consequences, such as black-market activity or excessive financial burdens on consumers.

Conclusion

Behavioral taxation represents a promising approach to addressing some of the most pressing social and environmental issues of our time. By leveraging insights from behavioral economics, governments can design tax policies that not only raise revenue but also promote healthier, more sustainable behaviors. The examples of sugar taxes in Mexico the United Kingdom and Portugal demonstrate how behavioral taxation can be used to reduce harmful activities and encourage beneficial ones, ultimately leading to better outcomes for society as a whole.

As governments around the world grapple with challenges like public health crises, the importance of behavioral taxation is likely to grow. By carefully designing and implementing these taxes, policymakers can nudge society toward a more sustainable and healthier future.